Build More Housing: The Big Picture

A version of this article also appeared on Streets.MN

Neighborhoods are designed, slowly and constantly, by the people who live in them. We make decisions about what gets built and who gets to use it or live in it through a network of community meetings, zoning boards, and city and state governments. In the process we create something we call “housing policy”. I have participated in a number of these discussions since moving to St. Paul, and they almost always focus on the details of a proposed building: how tall, what color, how many parking spaces, etc. Of course, I understand why: when designing and building homes that people will live in for a long time, it’s important to get the details right. The way a neighborhood or a city grows and changes is influenced by what gets built, so it’s natural that people want to have a say in what kind of housing is built near them.

But if we only ever focus on the height of a particular building or whether it’s made of brick or concrete, we might miss the big-picture forces that shape our city and ignore economic trends that are hurting many of our neighbors. So for a moment I’d like to set aside the details and zoom out to tell a story about what has happened in the Minneapolis-St. Paul metropolitan area over the past decade. The same trends have affected many other American cities, and I see no signs that these trends will cease over the next decade, perhaps with temporary slowdowns during the Covid-19 pandemic.

I would like to make one very simple argument. It’s something that many of my friends and neighbors understand intuitively, but it’s surprising to me that I don’t think I’ve ever seen it presented simply by elected officals or journalists.

Since 2009, the Twin Cities metro area has not added enough homes for the people who want to move here. The Twin Cities is a desirable place to live for many reasons, most prominently its strong job growth over the last decade. That increase in demand for housing without the supply to match it is the overwhelming reason why the cost of housing has increased every year since I’ve lived here. If we fail to build enough housing to meet demand for it, we should expect rents to continue to rise throughout the metro.

Discussing changes in housing, population, or jobs are essentially exercises in counting things, and of course sometimes the answers depend on how you count. For this article, I’m relying on data published by the U.S. Census Bureau and Bureau of Labor Statistics. Year-by-year estimates for population and housing units at the county level are available at the Census website. For job counts, I used the Quarterly Census of Employment and Wages provided by the Bureau of Labor Statistics. All of these numbers use the Seven-County Metro Area, an informal but widely-used grouping of Minneapolis, St. Paul, and their surrounding suburbs.

I should note here that I’m just a software developer with no formal experience in geography, statistics, or public policy. I did have friends with more specific expertise read drafts of this post, and I welcome corrections or notes on whether I’m using this data appropriately.

I’m using 2009 as the starting point of my analysis because it marked the end of the Great Recession (at least in terms of GDP) and started a decade of consistent population and job growth in the Twin Cities. The reasons why we’ve added so many jobs aren’t really important to my argument here, but my attempt at a summary explanation is that the Twin Cities benefits from a highly educated population, strong roots in growing healthcare and tech industries, and long-term trends toward urbanization across the US. The parks, lakes, and rivers are also quite nice, as long as you can tolerate the weather.

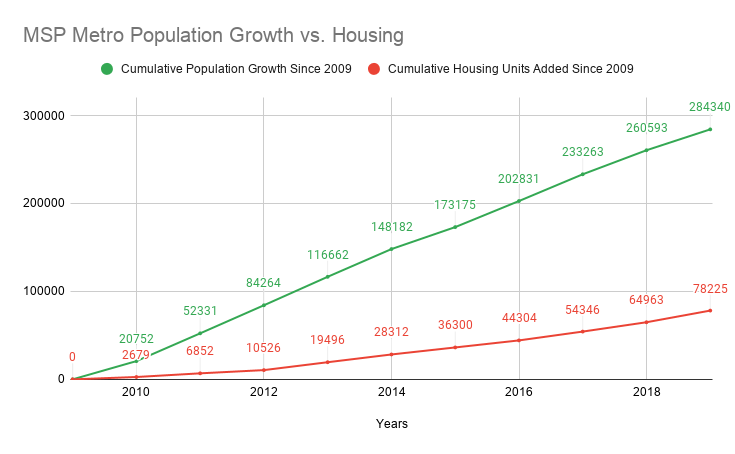

So let’s take a look at how the 7-county Minneapolis metro area has grown since 2009, in terms of people and housing units:

From 2009-2019, the Twin Cities grew by 284,340 people and added 78,225 houses or apartments in which to house them, nearly a 4:1 ratio of new people to new homes. That seems, well, like not enough housing, unless every last person who moved here is living double-bunked in a 2-bedroom apartment. Population growth can happen in lots of different ways, though - newborn babies have different housing needs than young professionals or retirees - so let’s also look at job growth in that same time period as a measure of housing demand independent of family size. Generally speaking, every new job will correspond with a new person who wants to live in the area, either by themselves or with their family.

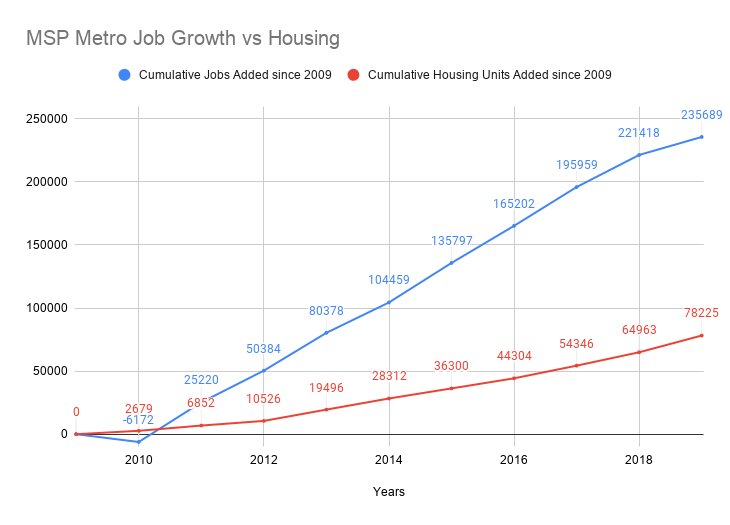

Okay, yep. That graph looks very similar. We’ve added 235,000 jobs to the metro area in the last decade, and the gap between added jobs and added housing seems to be growing larger.

This is the part where I say that when demand for a Thing increases and the supply of that Thing is not increased to match, the Thing becomes more expensive. Do I need to elaborate further, in a year where we have all seen this dynamic play out across a wide array of product categories? If you’ve tried to buy a bicycle or a rowing machine or a Playstation or a computer graphics card or a bag of flour or a case of toilet paper this year, you may have come to a situation where you had to choose between paying more than you otherwise would or going without. Housing is a market like any other, with a variety of potential buyers and sellers, and it’s subject to market forces. If we have a desirable place to live and we don’t build enough living places, we should expect the cost of a home in our city to continue to rise.

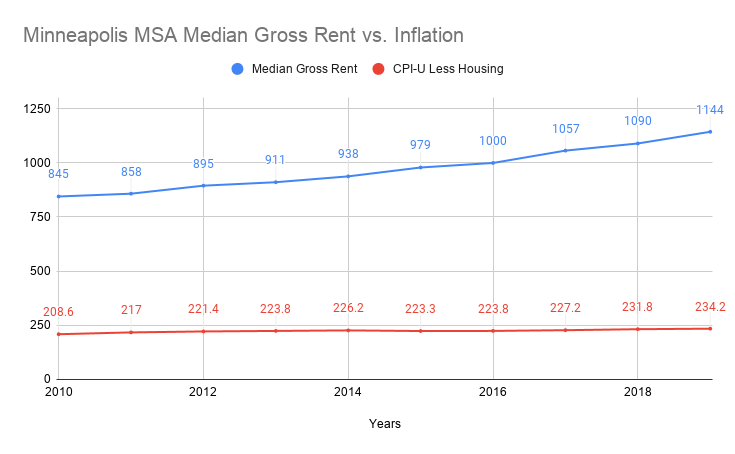

I could only find median gross rent for the Minneapolis Metropolitan Statistical Area, which is a larger zone than the 7-county metro, but I think it’s a fair way to illustrate the overall trend. Median rent has gone from $845 to $1,144 from 2010 to 2019, a 35% increase. I also plotted the national CPI-U (Consumer Price Index for All Urban Consumers) with housing costs removed, which only increased by 12% during the same time period. The price of housing has gone up a lot, and much more than the price of most other things we buy.

These rent numbers are metro-wide averages, so it’s safe to say that rents in the most desirable parts of Minneapolis and St. Paul have gone up even more. If anything, these numbers look tame compared to what’s happened to San Fransisco, Austin, or Seattle over the same timeframe, but these rent increases do incredible harm to people who find themselves priced out of their homes if their income doesn’t increase to match rising rents. Research on the relationship between housing prices and homelessness consistently shows that when homes become more expensive, more people end up unhoused.

I think it’s very important for the current citizens of desirable American cities to recognize and fight these trends by advocating for the construction of more homes. Most U.S. cities have inherited zoning codes created in more racist, classist, and exclusionary times than our own that continue to shape how our cities grow. We need more homes of many different shapes and sizes to help our cities grow to their full potential and help as many people as possible thrive within them. I’m happy to participate in discussion about how best to encourage growth that is humane and sustainable, but I think that discussion must start with a shared understanding of why housing is becoming unaffordable in American cities: a consistent, widespread lack of supply.

That’s what I mean when I say “Build More Housing”.

NOTES:

- You can see the data I collected for this post in a Google Sheet here: https://docs.google.com/spreadsheets/d/1ysmlxttCIHGBYBAE0H7a30IgMOYNIjPMGcvNARl8A3c/edit?usp=sharing

- Anton Schieffer did some great work with similar calculations for the missing housing in Minneapolis specifically in this post